Term Life Insurance: The Complete Guide

Discover why term life is the most affordable option, how it works, and when it's the right choice for your family.

Read More →Expert guidance to help you find the right policy for you and your family. Compare options, understand coverage, and make informed decisions.

Discover why term life is the most affordable option, how it works, and when it's the right choice for your family.

Read More →

Market-linked growth potential with downside protection. Learn why IUL is popular for retirement planning.

Read More →

Permanent coverage with guaranteed cash value growth. Everything you need to know about whole life policies.

Read More →

Everything you need to know about life insurance - how it works, who needs it, and how to choose the right policy.

Read More →

Build financial security with clear, practical steps. Learn about retirement accounts, investment strategies, and how to avoid common mistakes.

Read More →

Smart ways to grow your money by keeping more of what you earn through tax-advantaged accounts.

Read More →

How families build, protect, and pass on wealth that lasts for generations.

Read More →

How to build the safety net every household needs for unexpected expenses.

Read More →

Strategies to protect your money, your future, and your peace of mind from financial uncertainties.

Read More →

Long-term protection with built-in flexibility. Learn how universal life combines lifetime coverage with adjustable premiums and cash value growth.

Read More →

Debunking common myths and misconceptions about universal life insurance. Learn what's true and what's not about flexible premium permanent coverage.

Read More →

Learn how life insurance costs less than you think. Discover affordable options and how to make life insurance fit your budget.

Read More →

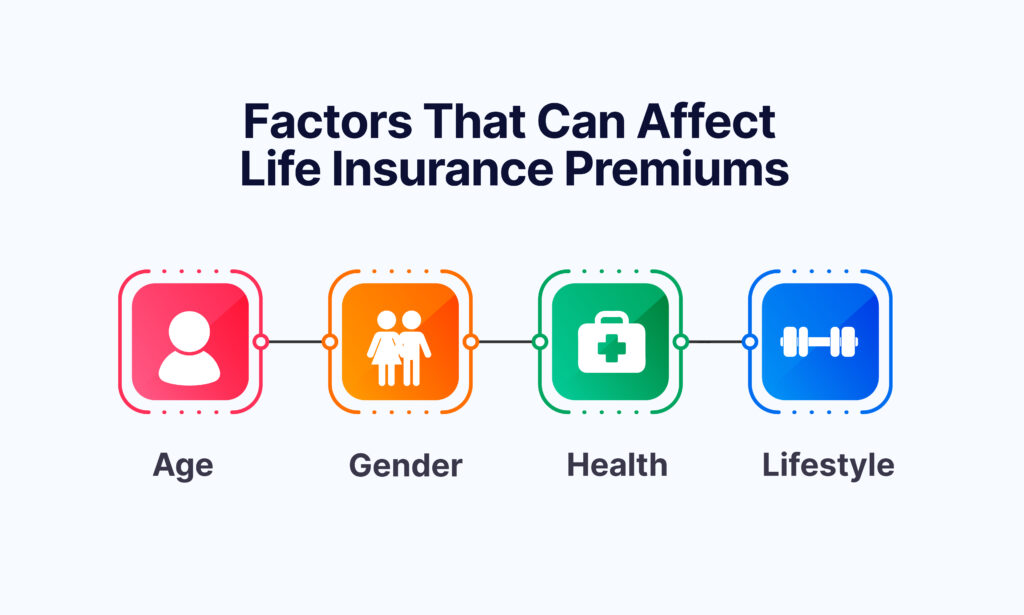

Understand the factors that influence universal life insurance pricing: age, health, lifestyle, coverage amount, and more.

Read More →

Learn practical strategies for budgeting life insurance without stress. Discover how to make coverage affordable and sustainable for your financial situation.

Read More →

Compare how daily spending habits like coffee and subscriptions compare to universal life insurance. Learn how intentional spending choices impact long-term financial health.

Read More →

Discover how universal life insurance adapts to your growing income, offering flexible coverage and long-term value that evolves with your financial success.

Read More →

Understand the savings component of permanent life insurance. Learn how cash value grows, how to access it, and whether it fits your financial strategy.

Read More →

Learn how traditional savings differ from insured savings through life insurance. Discover which option fits your financial goals and risk tolerance.

Read More →

Discover how life insurance can complement traditional retirement accounts. Learn about cash value, tax planning, and risk management in retirement.

Read More →

Learn how universal life insurance addresses unique planning challenges for blended families. Discover flexible protection for complex family dynamics.

Read More →

Discover how universal life insurance provides flexible protection for young families. Learn about coverage that grows with your children and adapts to changing needs.

Read More →

Discover how to prepare for life's unexpected events without fear or stress. Learn practical strategies for building confidence and financial flexibility.

Read More →

Discover the mindset and habits that lead to lasting insurance success. Learn how to make your policy work with your life for long-term value.

Read More →

Discover the complete process of how beneficiaries receive life insurance payouts. Learn about claim filing, verification, payout options, and timeline.

Read More →

Learn the five essential things everyone should know about life insurance. From protection basics to beneficiary choices, make confident insurance decisions.

Read More →

Discover why standardized life insurance policies often fail. Learn about the need for personalized coverage that adapts to your unique situation.

Read More →

Discover how to help families plan with confidence. Learn strategies for creating clarity, flexibility, and peace of mind in financial planning.

Read More →A common rule of thumb is 10-12 times your annual income. However, the exact amount depends on your debts, income replacement needs, and future expenses like college tuition. Consider these factors carefully to estimate the right amount for your family.

Term life insurance covers you for a specific period (10, 20, or 30 years) and is more affordable. Permanent life insurance (whole life, IUL) lasts your entire life and builds cash value, but costs more. Term is ideal for temporary needs like income replacement, while permanent is better for lifelong coverage and wealth building.

Indexed Universal Life (IUL) is a permanent life insurance policy that offers both a death benefit and cash value growth potential. Your cash value is linked to a stock market index (like the S&P 500) but with downside protection—you won't lose money when the market drops. It's ideal for those seeking life insurance plus tax-advantaged wealth accumulation.

The best time is now! Life insurance premiums are based on age and health. The younger and healthier you are, the lower your rates. Waiting can result in higher premiums or even disqualification due to health issues. Most people should consider coverage when they have dependents or significant debts.

Yes! Many people have multiple policies to cover different needs. For example, you might have a term policy for mortgage protection and an IUL policy for retirement planning. This strategy, called "layering," allows you to customize your coverage as your needs change over time.