For many people, the idea of budgeting for life insurance can feel intimidating. Words like premiums, policies, and coverage often make it seem more complicated than it really is. The truth is, budgeting for life insurance doesn't have to be stressful, confusing, or restrictive. With the right mindset and a few simple steps, it can actually feel empowering.

Life insurance isn't about preparing for the worst, it's about creating peace of mind. When approached calmly and realistically, it becomes just another part of a healthy financial routine rather than a source of anxiety.

Start With the "Why," Not the Numbers

One of the biggest reasons life insurance feels stressful is because people jump straight into numbers before understanding the purpose. Instead of asking, "How much will this cost me?" start with, "Who or what am I protecting?"

Life insurance exists to support loved ones, cover final expenses, or help maintain stability if something unexpected happens. When you focus on the reason behind the policy, the financial part often feels more meaningful and less burdensome. It's not just another bill, it's a form of protection.

Think of Life Insurance as a Monthly Utility

A helpful way to reduce stress is to mentally place life insurance in the same category as rent, electricity, or internet. It's a recurring expense that supports your overall well-being.

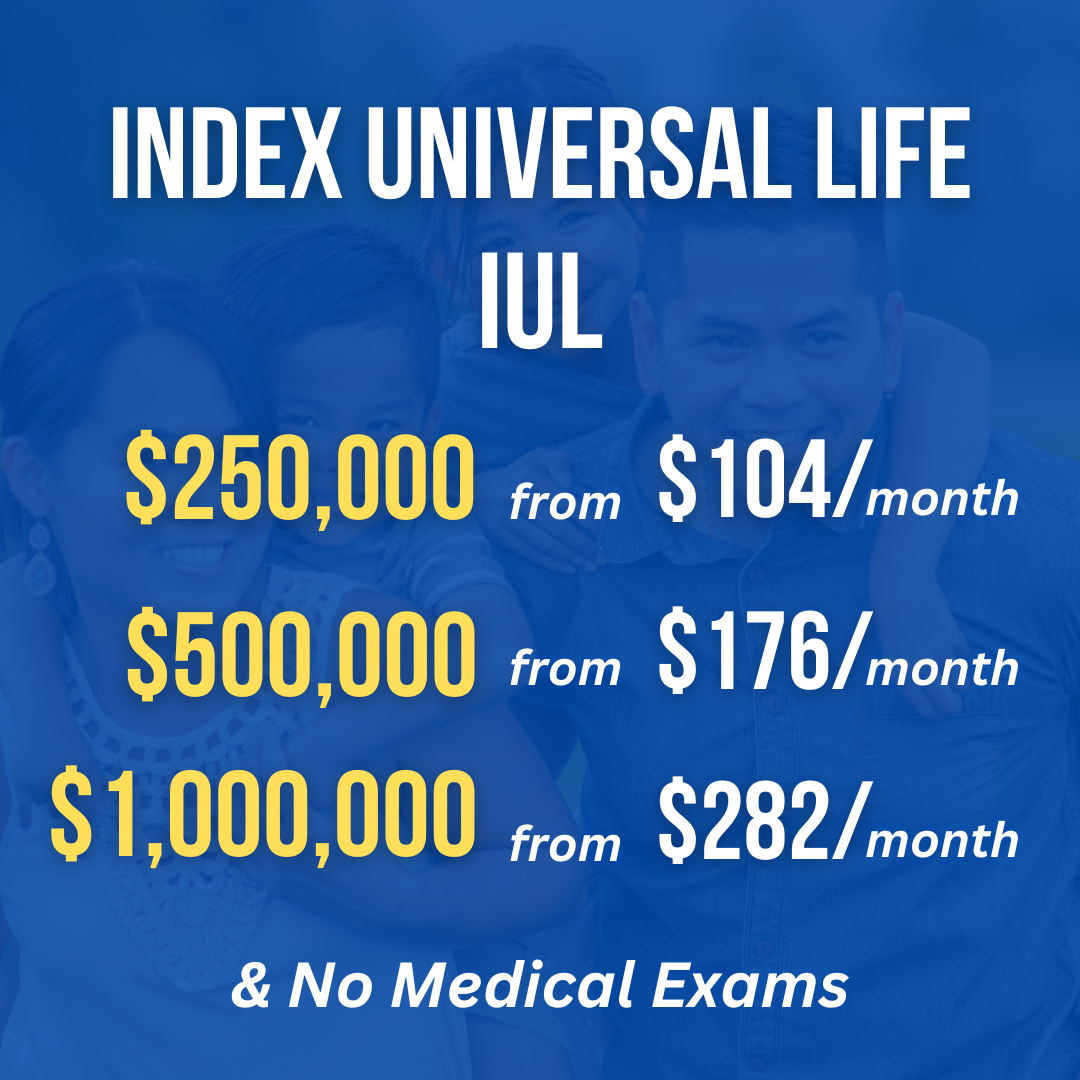

Most policies are designed to be affordable on a monthly basis. In many cases, coverage costs less than everyday habits like streaming subscriptions, dining out, or specialty coffee. Framing it this way can make life insurance feel less like a large commitment and more like a manageable, predictable expense.

💡 Money-Saving Perspective

The average monthly premium for a healthy 30-year-old buying term life insurance can be less than the cost of a daily coffee habit. Think of it as trading small daily expenses for long-term security.

Choose Coverage That Fits Your Current Life

A common misconception is that you need a "perfect" or "maximum" policy right away. In reality, life insurance is flexible, and your needs can change over time.

Budgeting without stress means choosing coverage that fits where you are right now. You don't need to plan for every future scenario all at once. A smaller, affordable policy that meets your current needs is far better than delaying coverage because you feel overwhelmed.

You can always adjust coverage later as income, family size, or goals evolve.

Build It Into Your Existing Budget Gently

Rather than restructuring your entire budget, look for small, realistic ways to make room for life insurance. This could mean:

- Redirecting money from an unused subscription

- Slightly adjusting discretionary spending

- Using part of a raise or bonus

- Choosing a policy with flexible payment options

The goal isn't perfection, it's balance. Even minor adjustments can create space without sacrificing comfort or enjoyment.

Avoid Comparison Pressure

Another major source of stress comes from comparison. Everyone's financial situation, responsibilities, and priorities are different. What works for someone else may not work for you and that's okay.

Budgeting for life insurance is a personal decision. The right policy is the one that fits your lifestyle, income, and peace-of-mind level. Ignoring outside pressure helps keep the process calm and intentional.

⚠️ Common Mistake

Don't let others' coverage amounts influence your decision. A family with young children and a mortgage has different needs than a single person with minimal debt. Focus on your specific situation.

Focus on Progress, Not Pressure

You don't need to have everything figured out at once. Simply taking steps toward coverage is progress. Whether you're exploring options, learning the basics, or setting aside a small monthly amount, each step matters.

Stress often comes from feeling rushed. Giving yourself permission to move at your own pace can completely change how budgeting feels.

Remember What You're Gaining

At its core, life insurance is about security and reassurance. Knowing that loved ones are protected, obligations are covered, or future uncertainty is reduced can actually lower financial stress not add to it.

When life insurance is budgeted thoughtfully and realistically, it becomes a source of confidence rather than concern.

🎯 The Real Benefit

Life insurance isn't an expense—it's an investment in peace of mind. The monthly premium buys you confidence that your family will be okay, no matter what happens.

A Calmer Way Forward

Budgeting for life insurance doesn't require strict rules, extreme sacrifices, or financial expertise. It simply requires clarity, honesty about your budget, and a willingness to take small, manageable steps.

When approached with patience and perspective, life insurance becomes less about fear and more about care for yourself, your family, and your future. And that's something worth budgeting for, without stress.

Key Takeaways

- Start with your "why" before worrying about costs

- Treat premiums like regular monthly utilities

- Choose coverage for your current situation, not future possibilities

- Make small budget adjustments rather than major overhauls

- Focus on your personal needs, not comparisons with others

- Remember that life insurance reduces stress, it doesn't create it