When people think about retirement planning, the usual topics come to mind: 401(k)s, IRAs, pensions, and Social Security. Life insurance is often viewed as something entirely separate, a tool meant only to provide protection if something unexpected happens. In reality, certain types of life insurance can play a meaningful supporting role in a well-rounded retirement strategy.

Understanding how life insurance can work alongside traditional retirement accounts can help people plan more confidently for both their future income needs and their loved ones' financial security.

Retirement Planning Is About More Than Income

At its core, retirement planning isn't just about replacing a paycheck. It's about managing risks, creating flexibility, and making sure your money lasts as long as you do. Market downturns, unexpected expenses, healthcare costs, and longevity can all impact retirement plans.

Life insurance can help address some of these risks by providing stability and predictability, two things that retirees often value highly.

The Role of Permanent Life Insurance

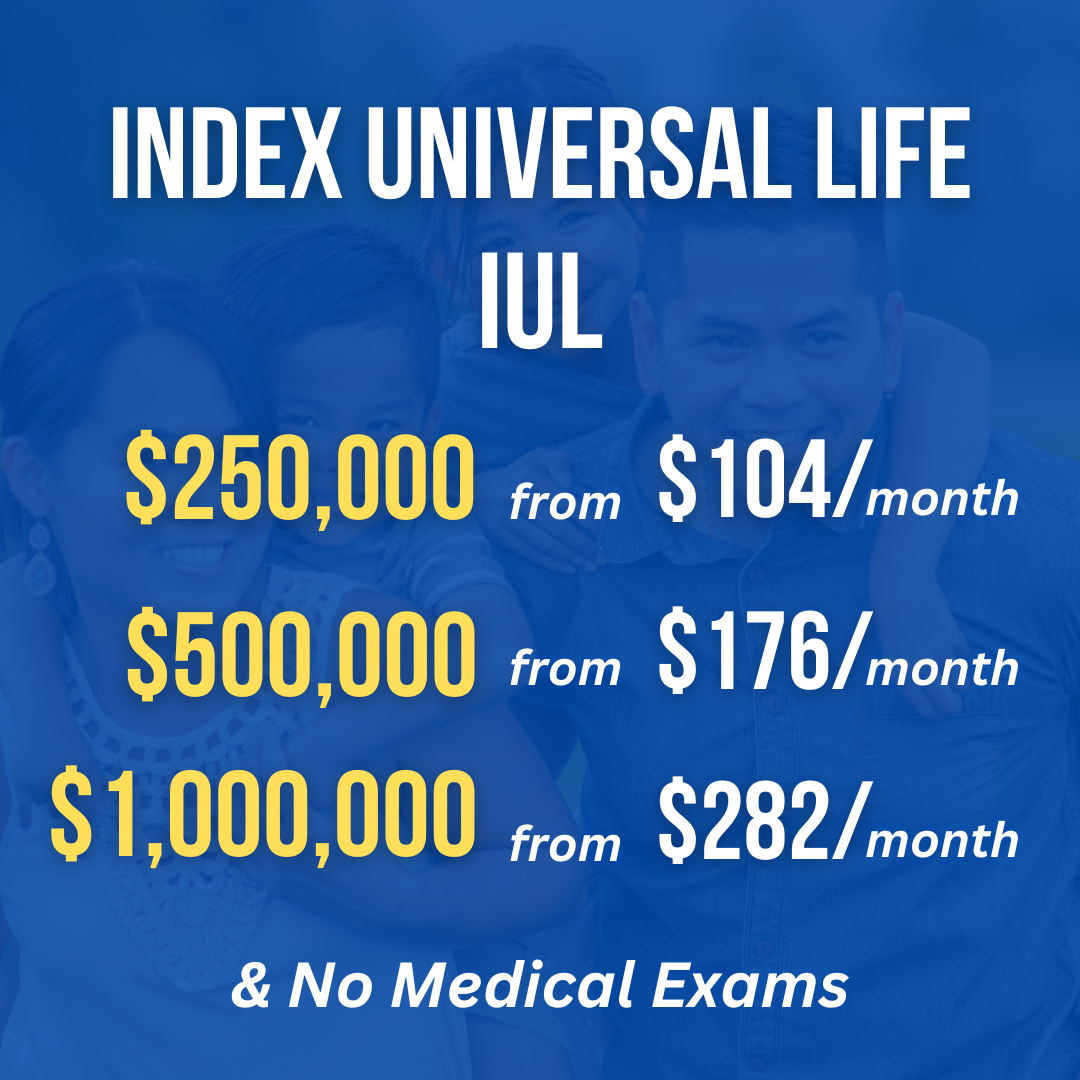

Not all life insurance works the same way. Term life insurance is typically designed for temporary protection and does not play a role in retirement income planning. Permanent life insurance such as whole life or universal life is different.

Permanent policies are designed to last for your entire life and often include a cash value component. This cash value grows over time under the rules of the policy and can be accessed later in life if needed.

This is where life insurance can begin to complement retirement planning.

💡 Key Difference

Unlike term life insurance which provides temporary protection, permanent life insurance combines lifelong coverage with a cash value component that can serve as a supplemental retirement resource.

Cash Value as a Supplemental Resource

Cash value life insurance is not a replacement for retirement accounts, but it can act as a supplemental financial resource. Over time, the cash value may be used to:

- Supplement retirement income

- Cover unexpected expenses

- Reduce reliance on taxable withdrawals from other accounts

Because cash value grows on a tax-deferred basis, it can provide flexibility when managing income during retirement. For some people, this added flexibility helps smooth out income during years when markets are down or expenses are higher than expected.

Managing Retirement Risk

One of the biggest challenges in retirement planning is managing risk, especially market risk and sequence-of-returns risk (poor market performance early in retirement).

Life insurance cash value is generally not directly tied to stock market volatility in the same way traditional investment accounts are. This can allow retirees to avoid selling investments during market downturns, using other resources instead and giving their portfolio time to recover.

This type of risk management can help retirement plans feel more resilient over time.

🎯 Risk Management Benefit

Having a non-correlated asset like life insurance cash value can provide stability during market downturns, allowing you to avoid selling investments at inopportune times.

Tax Planning Considerations

Taxes play a major role in retirement income planning. Withdrawals from traditional retirement accounts are often taxable, which can affect how long savings last.

Life insurance can sometimes provide access to funds with different tax treatment, depending on the policy structure and how funds are taken. This can help retirees:

- Balance taxable and non-taxable income

- Manage tax brackets

- Preserve other retirement assets longer

While tax rules can be complex, having multiple income sources with different tax characteristics can make retirement planning more flexible.

⚠️ Tax Complexity

The tax treatment of life insurance withdrawals and loans can be complex. Consult with a tax professional and insurance specialist to understand the implications for your specific situation.

Legacy and Protection Planning

Another benefit of including life insurance in retirement planning is the death benefit. Even if cash value is used during retirement, many policies are structured to maintain a benefit for beneficiaries.

This can be especially helpful for people who:

- Want to leave money to loved ones

- Are concerned about outliving their savings

- Want to offset taxes passed on to heirs

Life insurance can help ensure that using retirement assets during life doesn't mean sacrificing legacy goals.

Who Might Benefit Most?

Life insurance alongside retirement planning is not for everyone, but it may be particularly appealing for individuals who:

- Have already maximized traditional retirement accounts

- Value stability and predictability

- Want additional financial flexibility later in life

- Are planning for both retirement income and legacy needs

It works best when viewed as a long-term strategy rather than a short-term solution.

Putting It All Together

Using life insurance as part of a retirement plan is about coordination, not replacement. Traditional retirement accounts are still the foundation for most people. Life insurance can serve as an additional layer, one that helps manage risk, provide flexibility, and support long-term goals.

When thoughtfully integrated, life insurance can help bridge gaps that other retirement tools may leave behind, offering peace of mind both during retirement and beyond.

A Balanced Approach

The most effective retirement plans tend to use multiple tools working together. Life insurance, when used appropriately, can support income planning, risk management, tax efficiency, and legacy goals—all without needing to choose one strategy over another.

As with any financial decision, understanding how the pieces fit together is key. When retirement planning focuses not just on growth, but also on protection and flexibility, life insurance can become a valuable part of the conversation.

Key Takeaways

- Life insurance can complement traditional retirement accounts

- Permanent policies offer cash value that grows tax-deferred

- Cash value can provide stability during market downturns

- Different tax treatment offers planning flexibility

- Death benefits support legacy planning goals

- Works best as a long-term strategy, not short-term solution