Saving money is one of the most common financial goals people share. Whether it's for emergencies, future plans, or peace of mind, putting money aside is generally seen as a smart move. However, not all savings work the same way. Two terms that often come up—sometimes interchangeably—are savings and insured savings. While they may sound similar, there are important differences between the two.

Understanding how each works can help you make more informed decisions about where to keep your money and how to protect it.

What Is Traditional Savings?

Traditional savings usually refers to money held in common financial accounts such as:

- Savings accounts

- Checking accounts

- Money market accounts

- Certificates of deposit (CDs)

These accounts are typically offered by banks and credit unions. They are designed to keep your money accessible while earning modest interest. Traditional savings accounts are widely used for emergency funds, short-term goals, and everyday financial needs.

One key advantage of traditional savings is liquidity, meaning you can usually access your money quickly and easily. However, interest rates on these accounts are often relatively low and may not always keep up with inflation over time.

What Does "Insured" Mean in Financial Terms?

The word insured refers to protection against loss. When savings are insured, it means there is a system in place to protect your money if the institution holding it fails.

For example:

- Bank accounts are often insured by the Federal Deposit Insurance Corporation (FDIC)

- Credit union accounts are typically insured by the National Credit Union Administration (NCUA)

These protections usually cover deposits up to a certain limit per account holder. This insurance helps ensure that even if a bank or credit union closes, depositors can recover their funds within the insured amount.

💡 FDIC Insurance Limits

The FDIC typically insures deposits up to $250,000 per depositor, per insured bank, for each account ownership category. This protection applies to savings accounts, checking accounts, and other deposit accounts.

What Are Insured Savings?

Insured savings can refer to two different but related concepts:

- Savings held in insured financial institutions, such as FDIC-insured savings accounts

- Savings mechanisms that include built-in insurance features, such as certain life insurance policies

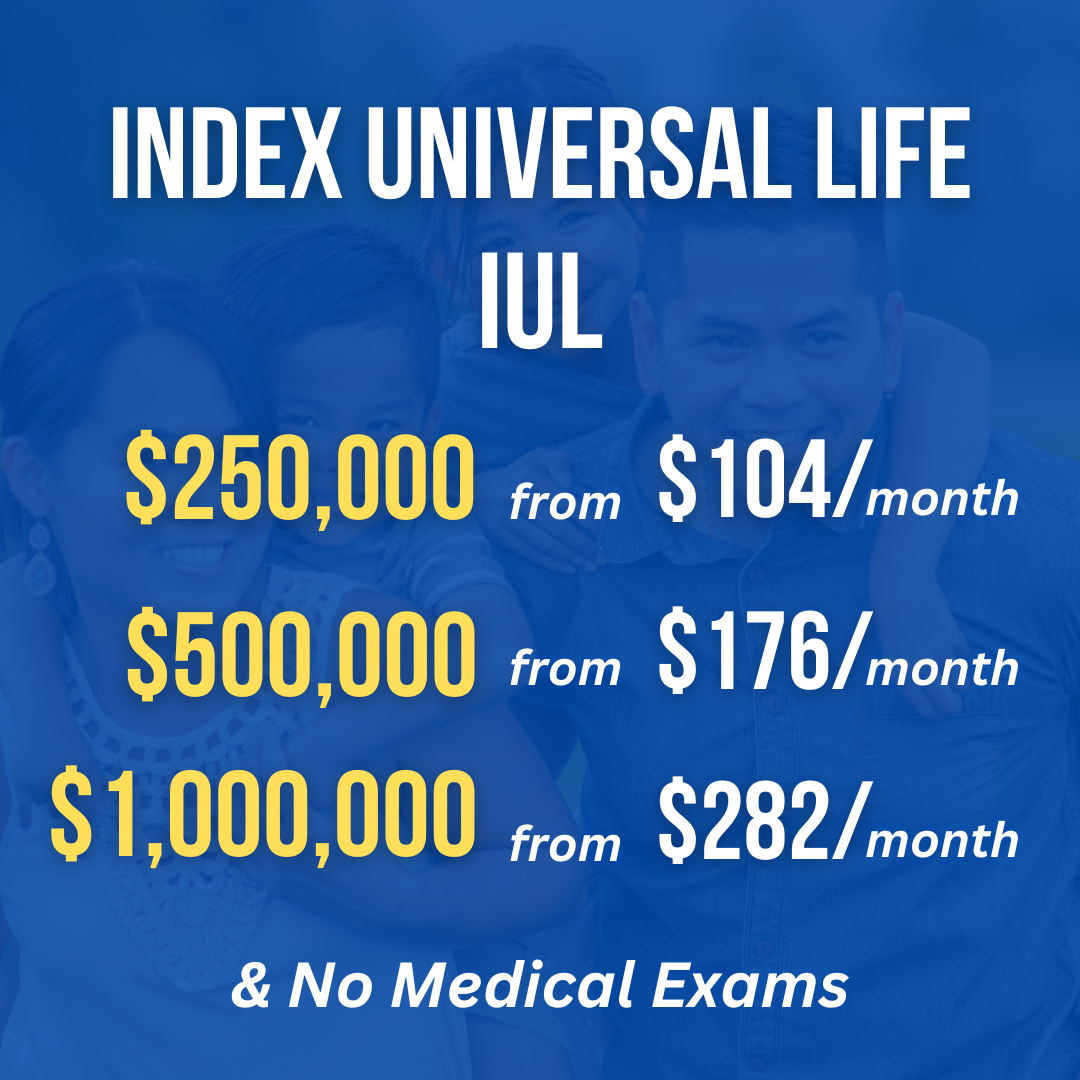

In the second case, insured savings often refers to cash value within permanent life insurance policies. These policies combine insurance protection with a savings-like component that grows over time under specific rules.

How Insured Savings Through Insurance Work

Permanent life insurance policies, such as whole life or universal life, include a cash value component. A portion of the premium goes toward building this cash value, which grows over time on a tax-deferred basis.

What makes this type of savings "insured" is that:

- It is backed by the insurance contract

- Growth follows policy guarantees or defined crediting methods

- It is not directly exposed to market losses in many policy types

While access to these funds may be more structured than a bank account, the trade-off is added stability and long-term planning benefits.

🎯 Key Advantage

Insured savings through life insurance offers tax-deferred growth and protection from market volatility, making it attractive for long-term financial planning.

Key Differences Between Savings and Insured Savings

The differences between traditional savings and insured savings go beyond where the money is stored.

Purpose

Traditional savings are often used for short-term needs and emergencies. Insured savings through insurance are usually designed for long-term planning and financial stability.

Accessibility

Savings accounts allow frequent and easy access. Insured savings may have conditions, limits, or long-term considerations when accessing funds.

Growth Potential

Savings accounts typically offer modest interest. Insured savings may grow at a more predictable or structured rate, depending on the policy.

Protection

While bank savings are insured against institutional failure, insured savings through insurance also include protection tied to the policy itself, often designed to remain intact even during economic downturns.

⚠️ Important Consideration

Insured savings through life insurance typically requires premium payments and may have surrender charges for early withdrawals. Consider your liquidity needs before committing funds.

Which Option Is Better?

There is no one-size-fits-all answer. Traditional savings and insured savings serve different purposes and can complement each other rather than compete.

Traditional savings are often ideal for:

- Emergency funds

- Short-term expenses

- Everyday financial flexibility

Insured savings may be better suited for:

- Long-term financial planning

- Stable growth goals

- Individuals who value protection alongside savings

Many people choose to use both—keeping accessible cash in savings accounts while building insured savings for the future.

Why the Difference Matters

Understanding the difference between savings and insured savings helps avoid confusion and unrealistic expectations. Each option has strengths and limitations, and knowing how they work allows you to choose the right tool for the right job.

Rather than asking which is "better," a more useful question is how each fits into your overall financial plan.

The Takeaway

Savings help you manage today. Insured savings help protect tomorrow. When used together, they can provide both flexibility and long-term confidence. By understanding how each works, you can make decisions that support both your immediate needs and your future goals without unnecessary stress or complexity.

Key Takeaways

- Traditional savings offer liquidity for short-term needs

- Insured savings through insurance provide long-term stability

- Both options serve different purposes in a financial plan

- Bank deposits are FDIC-insured up to $250,000

- Life insurance cash value grows tax-deferred

- Consider using both options for comprehensive financial planning