Blended families are becoming more common, and with them come unique financial planning considerations. When spouses bring children from previous relationships, share children together, or manage obligations across multiple households, planning for the future can feel more complex. One area where this complexity often shows up is life insurance.

Universal life insurance can be a useful tool for blended families because it combines long-term protection with flexibility. When structured properly, it can help balance competing priorities, protect loved ones fairly, and adapt as family needs change over time.

Why Blended Families Face Unique Planning Challenges

In traditional family structures, life insurance planning is often straightforward: protect a spouse and children with a single death benefit. In blended families, the picture can be more nuanced. Some common concerns include:

- Ensuring a current spouse is financially secure

- Providing for children from a previous relationship

- Avoiding future conflicts between heirs

- Managing child support or alimony obligations

- Adjusting plans as family dynamics evolve

Universal life insurance offers features that can help address these challenges more effectively than one-size-fits-all solutions.

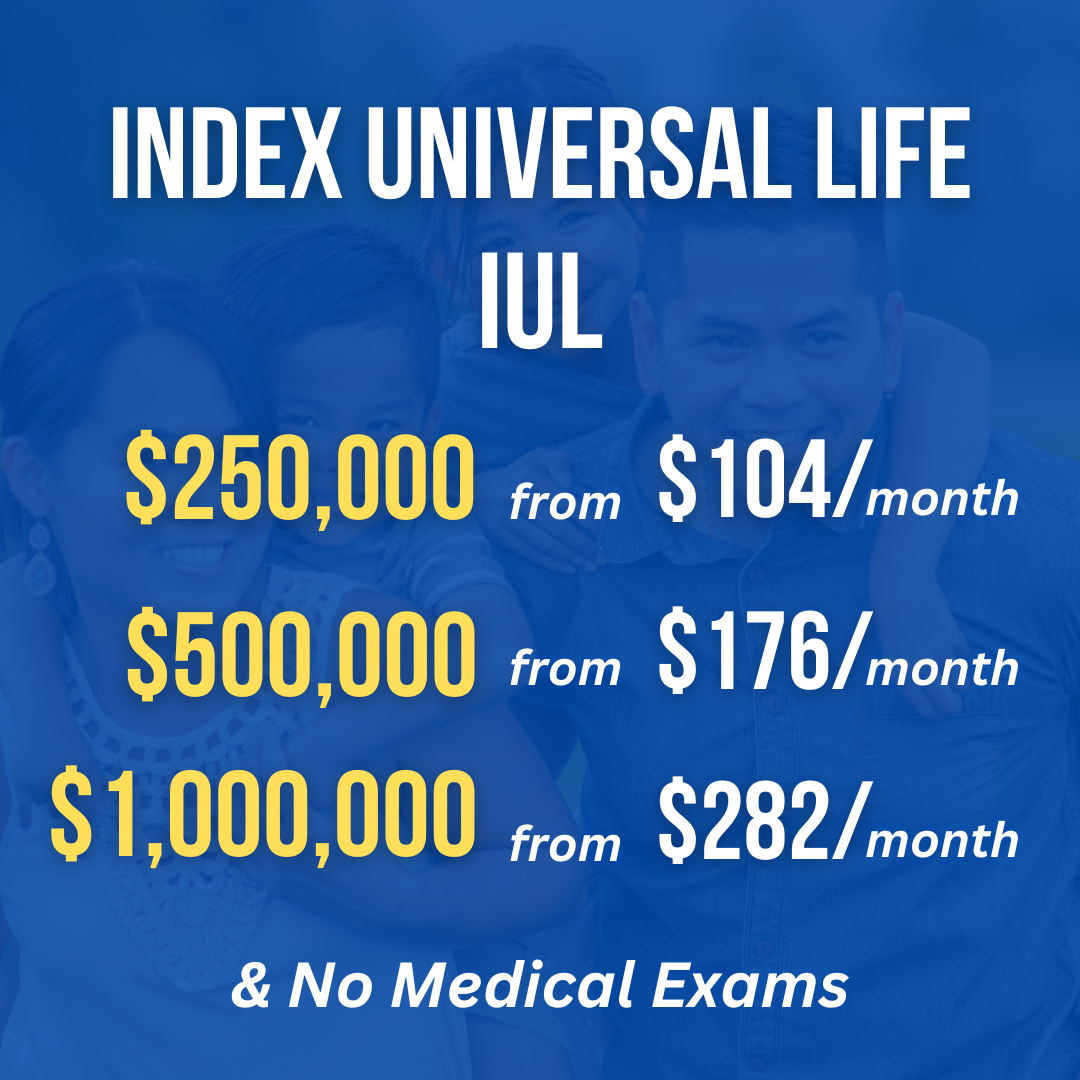

What Is Universal Life Insurance?

Universal life insurance is a type of permanent life insurance designed to last for your lifetime. It provides a death benefit while also allowing policies to build cash value over time. One of its key advantages is flexibility—policyholders may be able to adjust premiums, death benefits, and how cash value is used, depending on the policy and carrier rules.

This adaptability can be especially valuable for blended families whose needs may change as children grow older or financial responsibilities shift.

💡 Key Advantage

The flexibility of universal life insurance allows blended families to adjust coverage as needs change, ensuring protection remains appropriate as family dynamics evolve.

Protecting a Spouse While Preserving a Legacy

One common concern in blended families is balancing financial support for a surviving spouse while ensuring children from a previous relationship are not unintentionally disinherited.

Universal life insurance can help by providing a dedicated death benefit that supports a spouse without requiring other assets such as retirement accounts or property to be used up. This can allow those assets to pass to children according to the family's wishes.

In some cases, universal life insurance is used alongside trusts or beneficiary planning to create clear, structured outcomes that reduce misunderstandings later.

Customizable Death Benefits

Another advantage of universal life insurance is the ability to tailor the death benefit. Some policies allow adjustments over time, which can be helpful as obligations change.

For example:

- Coverage needs may be higher when children are young

- Financial responsibilities may decrease as children become independent

- A policy can be reviewed and adjusted as family priorities evolve

This level of customization helps blended families avoid over- or under-insuring at different life stages.

Supporting Multiple Financial Responsibilities

Blended families often juggle multiple financial obligations at once, such as:

- Supporting a current household

- Paying child support or alimony

- Planning for college expenses

- Saving for retirement

Universal life insurance can be structured with flexible premium payments, allowing families to contribute more during high-income years and less during tighter periods, as long as policy requirements are met. This can help families stay protected without adding unnecessary financial strain.

🎯 Financial Flexibility

Flexible premium options allow blended families to adjust payments based on changing financial circumstances while maintaining essential protection.

Cash Value as a Financial Buffer

The cash value component of universal life insurance can provide additional peace of mind. Over time, cash value may be accessed to help cover unexpected expenses or temporary financial gaps.

For blended families, this flexibility can be useful when:

- Covering emergency costs

- Managing transitions between households

- Supporting family needs without disrupting long-term plans

While cash value should be used thoughtfully, having an additional financial resource can help families navigate uncertainty more confidently.

Clarity and Transparency Matter

One of the most important aspects of planning for blended families is clarity. Universal life insurance policies allow beneficiaries to be clearly defined, which can help reduce confusion or disputes later on.

Regular policy reviews are essential. As marriages, divorces, births, or financial circumstances change, keeping life insurance aligned with current goals helps ensure everyone is protected as intended.

⚠️ Important Reminder

Blended families should review their life insurance policies regularly, especially after major life events like marriages, divorces, or births, to ensure coverage remains appropriate.

Is Universal Life Right for Every Blended Family?

Universal life insurance is not a universal solution, but it can be a strong option for families who:

- Want permanent coverage

- Need adaptable protection over time

- Are planning for both current and future family members

- Prefer solutions that can evolve with their family structure

As with any financial strategy, it's most effective when coordinated with broader estate and financial planning.

Planning with Confidence

Blended families deserve financial plans that respect their unique dynamics. Universal life insurance can help provide structure, fairness, and adaptability—all while offering long-term protection for the people who matter most.

By thoughtfully integrating universal life insurance into a broader plan, blended families can move forward with greater confidence, knowing their loved ones are protected today and in the years ahead.

Key Takeaways

- Universal life insurance offers flexibility for evolving family needs

- Can balance protection for spouses and children from previous relationships

- Customizable death benefits adapt to changing financial responsibilities

- Cash value provides additional financial flexibility

- Clear beneficiary designation helps prevent future conflicts

- Regular policy reviews ensure coverage remains appropriate