Life insurance can feel complicated when you first start exploring your options, but at its core, it's simply a financial safety net. The right policy helps protect the people you care about most and gives them financial stability during a difficult time. Whether you're planning for a family, preparing for the future, or comparing coverage types, understanding how these policies work is the first step toward choosing the right fit.

How Life Insurance Works

A life insurance policy is a contract between you and an insurance company. As long as you continue paying your premiums, the insurer promises to provide a payout—called the death benefit—to the beneficiaries you choose. These beneficiaries might be your spouse, your children, or anyone else you want to provide for.

One key benefit is that life insurance payouts are typically tax-free, and loved ones can use the funds however they need—covering funeral costs, paying off debt, or maintaining their household expenses.

Most policies cover both natural and accidental death. Some plans also offer living benefits: early access to a portion of your payout if you're diagnosed with certain serious conditions.

💡 Interesting Fact

The person who owns the policy and the person who is insured don't always have to be the same. For example, you can buy a policy for a spouse or business partner and name yourself as the beneficiary.

Who Should Consider Life Insurance?

Life insurance is meant to replace income or provide financial support after the policyholder is gone. Many people choose to buy it when they take on major responsibilities—such as raising children, purchasing a home, or supporting aging parents.

You may want to consider life insurance if:

- You have a spouse, children, or others who rely on your income

- You want to ease the financial burden of funeral and end-of-life expenses

- You have debts that could fall on someone else after you pass

- You own a business and want to protect its continuity

You might not need life insurance if:

- No one depends on you financially

- You already have enough assets to cover final expenses

- You won't leave behind any debts or financial obligations

Types of Life Insurance: Term vs. Permanent

Life insurance falls into two major categories: term life and permanent life. The right choice depends on your needs, your financial goals, and your long-term plans.

Term Life Insurance

Most AffordableTerm life insurance is the simplest and most affordable type of coverage. It provides protection for a set number of years—commonly 10, 20, or 30. If you pass away during the term, your beneficiaries receive the death benefit. If the policy expires first, the coverage ends.

Most term policies have fixed premiums and level benefits. Other options include:

- Annual Renewable Term: Renews each year with rising premiums

- Decreasing Term: The death benefit declines over time while premiums stay constant. Often used to cover mortgages or loans

Why many people choose term life

It's budget-friendly, easy to understand, and ideal for covering temporary financial responsibilities—like raising kids or paying off debt.

Permanent Life Insurance

Lifetime CoveragePermanent life insurance lasts your entire lifetime and includes a cash value component that grows over time. This savings-like feature earns interest at a fixed or variable rate, depending on the policy type. Once enough cash value has accumulated, you may be able to borrow from it, withdraw funds, or even use the earnings to pay your premiums.

Types of permanent life insurance include:

- Whole Life Insurance: Offers guaranteed premiums, guaranteed death benefits, and guaranteed cash value growth

- Burial or Final Expense Insurance: A smaller whole-life policy designed specifically for end-of-life costs

- Universal Life Insurance: Provides flexibility to change premiums and death benefits as your needs evolve

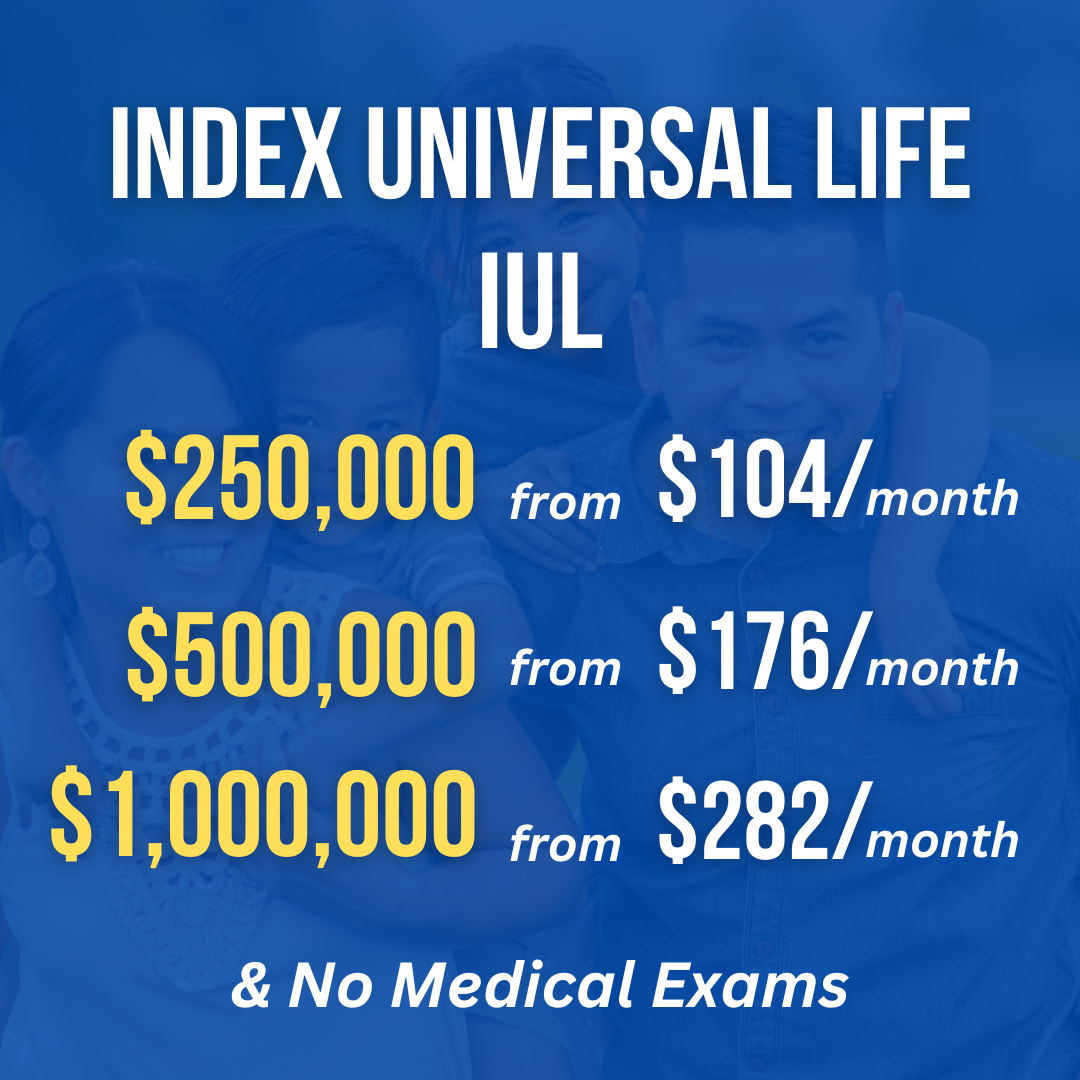

- Indexed Universal Life: Cash value growth is tied to a market index, such as the S&P 500

- Variable Universal Life: Allows you to choose how your cash value is invested through various fund options

Why choose permanent coverage

It's suitable for long-term needs, such as planning care for a dependent with lifelong needs or ensuring your beneficiaries receive an inheritance regardless of when you pass.

Questions to Ask When Choosing a Policy

Your goals determine the best policy type. For example:

- To replace income → Consider term life

- To leave an inheritance → Term or permanent life

- To cover debts → Term life aligned with your payoff timeline

- To cover final expenses → Burial insurance

- To build cash value or invest → Permanent life (such as indexed or variable universal)

Most insurers require basic health questions and sometimes a medical exam. If you prefer to skip the exam, you can look for:

- Instant-issue life insurance (fast approval with health questions only)

- Guaranteed-issue life insurance (no medical questions, typically for older adults needing final expense coverage)

Note: Exam-free policies are convenient but often cost more.

Since you may pay premiums for decades, it's essential to choose a policy you can comfortably afford.

- Term life is usually the most budget-friendly

- Permanent life costs more due to its lifelong coverage and cash value

If you want permanent insurance later but not today, consider a convertible term policy, which allows you to switch to permanent coverage without a new exam.

Start by adding up your financial responsibilities:

- Mortgage or rent

- Childcare/education costs

- Outstanding loans or debts

- Income replacement needs

Then subtract savings or assets available to your family. Many people use rules of thumb—such as 10–15 times income—but personal circumstances vary.

Life insurance riders can customize your policy. Common add-ons include:

- Accelerated death benefit: Access part of your benefit if diagnosed with a terminal illness

- Child term rider: Adds children to your policy

- Guaranteed insurability: Allows future coverage increases without a medical exam

- Waiver of premium: Pauses payments if you become disabled

How Much Does Life Insurance Cost?

Costs vary based on your age, health, coverage amount, and policy type. For example, a healthy 30-year-old woman might pay:

- Whole life: Around $3,959 per year

- 20-year term life: Around $187 per year

Other factors that affect price include gender, family medical history, smoking status, and high-risk occupations or hobbies.

How to Buy a Life Insurance Policy

-

Gather quotes

You can compare prices through insurance companies directly, online comparison tools, or independent agents/brokers.

-

Compare more than just price

Look for: Financial strength ratings, Customer service reputation, Consumer complaint history, Optional riders, Conversion options or policy flexibility

-

Complete the application

Provide honest information, choose your beneficiaries, and finalize your premium schedule. Some policies may take a few weeks to be approved.

Once you're covered, revisit your policy periodically—especially after major life events like marriage, divorce, or having a child—to ensure your coverage still fits your needs.

Ready to Get Started?

Explore our comprehensive guides to find the perfect life insurance policy for your needs.

View All Articles