Life rarely goes exactly as planned. Unexpected events such as a job change, illness, emergency expense, or family transition can happen to anyone at any time. While thinking about these possibilities can feel uncomfortable, planning for them doesn't have to be stressful or fear-driven. In fact, thoughtful preparation can reduce anxiety and create a greater sense of control.

Planning for the unexpected isn't about assuming the worst. It's about creating flexibility, building confidence, and knowing you have options if life takes an unexpected turn.

Why Planning Feels Overwhelming for Many People

Many people avoid planning for unexpected situations because it feels heavy or intimidating. Words like "emergency," "insurance," and "worst-case scenario" can trigger stress, especially when finances are already stretched.

But preparation doesn't have to mean dramatic lifestyle changes or constant worry. When approached calmly and gradually, planning can actually bring peace of mind. The goal isn't perfection, it's progress.

Reframing the Purpose of Planning

Instead of thinking about planning as preparing for disaster, it helps to see it as:

- Giving yourself more choices

- Protecting your future flexibility

- Reducing last-minute decisions during stressful moments

Planning is less about predicting what will happen and more about being ready to respond if something does.

💡 Mindset Shift

Think of planning not as preparing for disaster, but as creating options and flexibility that make life easier, regardless of what happens.

Start With What You Can Control

The most effective plans begin with simple, manageable steps. You don't need to solve everything at once.

Some foundational areas to consider include:

- A basic understanding of your monthly expenses

- Knowing where important documents are kept

- Identifying who depends on your income

- Understanding what financial tools you already have in place

Even small steps in these areas can significantly reduce uncertainty.

Building a Financial Cushion Without Pressure

An emergency fund is often one of the first things mentioned in financial planning and for good reason. Having money set aside for unexpected expenses can help prevent panic when surprises arise.

That said, building a cushion doesn't have to be aggressive or overwhelming. Saving small amounts consistently is often more effective than trying to save large sums quickly. The key is sustainability, not speed.

The presence of a financial buffer—no matter the size—can change how unexpected situations feel. Instead of panic, there's room to breathe.

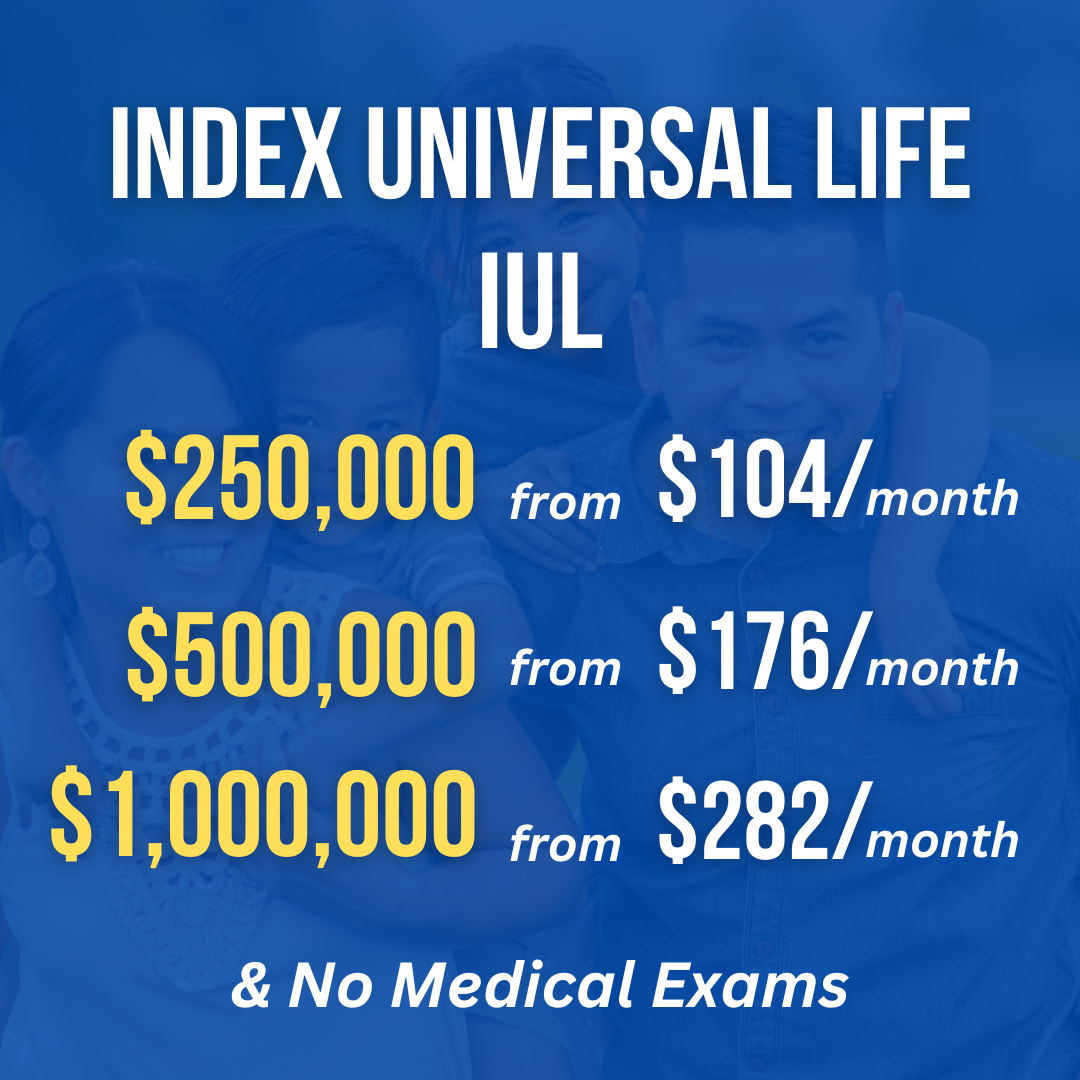

The Role of Protection in Unexpected Events

Planning also involves protecting what matters most. This may include ensuring that loved ones are financially supported if something happens to you, or that essential expenses can still be covered during difficult periods.

Protective tools like insurance are designed to absorb financial shocks so you don't have to face them alone. When set up properly, they function quietly in the background—offering reassurance without demanding constant attention.

The purpose of protection is not fear, but stability.

🎯 Protection Purpose

Insurance and other protective tools work silently in the background, providing stability when you need it most without adding to daily stress.

Flexibility Matters More Than Perfection

One common misconception is that planning requires locking yourself into rigid systems. In reality, flexibility is one of the most valuable elements of any plan.

Life changes. Careers evolve. Families grow. Financial strategies that allow adjustments over time are often more effective than those that demand strict adherence.

A flexible plan acknowledges that circumstances may shift—and that's okay.

Avoiding Panic During Uncertain Moments

Panic often comes from feeling unprepared or rushed into decisions. Planning ahead reduces the need to make major choices under pressure.

When unexpected events occur, having even a loose framework can help you:

- Slow down decision-making

- Evaluate options more clearly

- Focus on solutions instead of stress

Preparation doesn't eliminate challenges, but it changes how you experience them.

⚠️ Remember This

The goal of planning isn't to prevent unexpected events, but to reduce their emotional and financial impact when they do occur.

Planning Is an Ongoing Process

Planning for the unexpected isn't a one-time task. It's a process that evolves with your life. Periodic check-ins allow you to adjust plans based on current needs, goals, and priorities.

Rather than viewing planning as something you "finish," think of it as something you revisit gently and intentionally.

Let Preparation Create Peace, Not Fear

The most important thing to remember is that planning should make life feel lighter, not heavier. When done thoughtfully, it reduces worry rather than adding to it.

Planning for the unexpected isn't about living in fear of what might go wrong. It's about knowing that if something does, you won't face it unprepared.

Calm planning creates confidence. And confidence allows you to focus on living fully in the present, knowing that whatever comes next, you've taken steps to be ready.

Key Takeaways

- Planning should create peace, not fear

- Start with small, manageable steps

- Build financial flexibility gradually

- Protection tools work silently in the background

- Flexibility matters more than rigid perfection

- Planning is an ongoing process, not a one-time task